Meet Tomorrow’s Homeowner: All 1000 of Them

It has recently come out that the average homeowner in America is age 47, a radical departure from earlier decades in the country where home buyers were typically in their late 20’s and 30’s. This is at least partially due to the skyrocketing costs of real estate within city limits of major population centers, where younger people tend to congregate and seek higher paying jobs and more exciting lifestyles.

This bleak picture shows us a real disparity in wealth between subsequent generations, as home ownership and real estate is one of the primary mechanisms of wealth accumulation and investment. As less and less young people count themselves among property owners, their net worth similarly becomes much lower than their parents.

So, what can be done about this precarious situation, where the generational wealth gap seems to get wider and less surmountable every year? Well, as the great man said “Life…uh, finds a way.” With advancements in technology, new methods of investment and property ownership are also being developed and discovered, one of the most exciting being the fractional real estate exchange.

With fractional real estate, the ownership of property is effectively democratized. The company RealT is providing a buying and selling platform that connects a percentage of a property’s ownership and value to what is called a ‘security token’ (referred to as a RealToken), which is tied to the value of the cryptocurrency Ethereum. As the property changes in value, as all properties do, all investors in the home benefit from those changes in accordance with what percentage of the home they own.

This exchange is automatically run by a specially designed algorithm that ensures there is a consistent level of liquidity in the exchange so that people can buy and sell freely without significantly altering the price of the token or the asset. I’ll let them explain a little bit more of how the process works:

At RealT, we went through an extensive research phase, weighing the pros and cons of various liquidity mechanisms for our properties and users. There are a number of different options for exchanging tokens and generating liquidity, but none of them provide the elegance and simplicity of Uniswap…

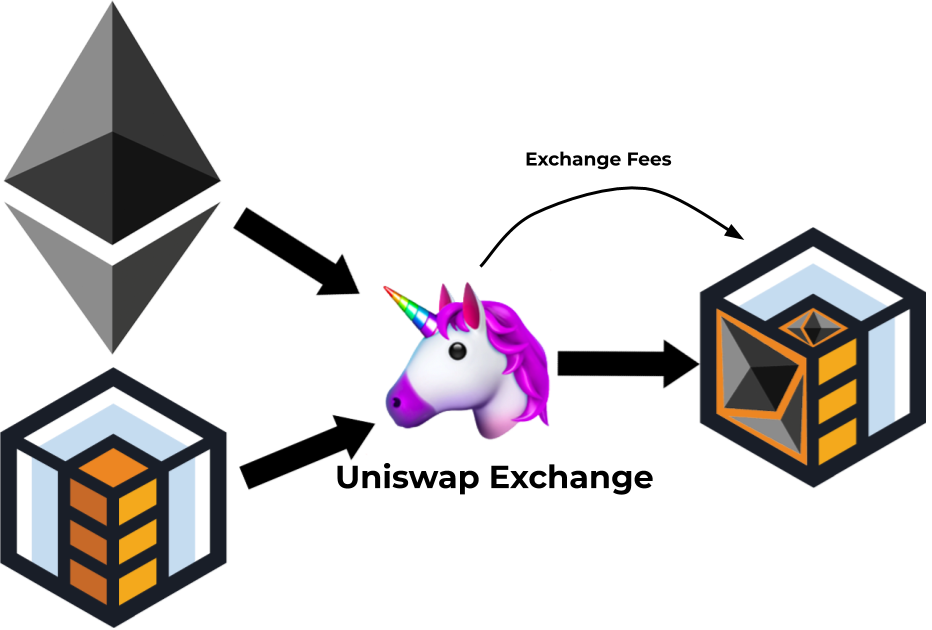

Uniswap Exchange operates by holding two assets inside a trading pair. The valuation of each asset is a function of the total value in each pool. For example, if Token A is worth $100, and Token B is worth $2, then there will be 50x the number of tokens in Pool A than in Pool B in order to keep the two pools of assets valued equally.

Uniswap liquidity grows when liquidity providers submit an equal-value amount of both assets to the pools. The larger the pools, the more the liquidity, and the less slippage for traders.

With the ability to buy in to a property and sell out whenever you desire, the fractional real estate exchange not only allows for wealth accumulation for a tech-minded generation that has been thus far left behind, but also gives them an advantage over their parents, who often are forced to stick to their investments no matter what the situation in the market is. Quick exchange means opportunities can be capitalized on quickly and dangerous investments can be quickly dropped with the bare minimum of loss.

RealT puts it this way:

Uniswap enables you to sell your property on a whim. Unexpected bill? Want a night out on the town? Just need some cash? If your property is a RealT property, you can instantly sell your property.

The biggest question we get at RealT is “What if I want to sell my property?” At RealT, we’re overjoyed to be able to offer our customers a feature we’ve always wanted: Instant liquidity for real estate.”

With fractional real estate, it’s possible that we can start bridging the generational wage gap and, perhaps, heal the generational divide that is driving the creation of hurtful flippant memes like the “ok, boomer” meme that has become so popular world-wide.